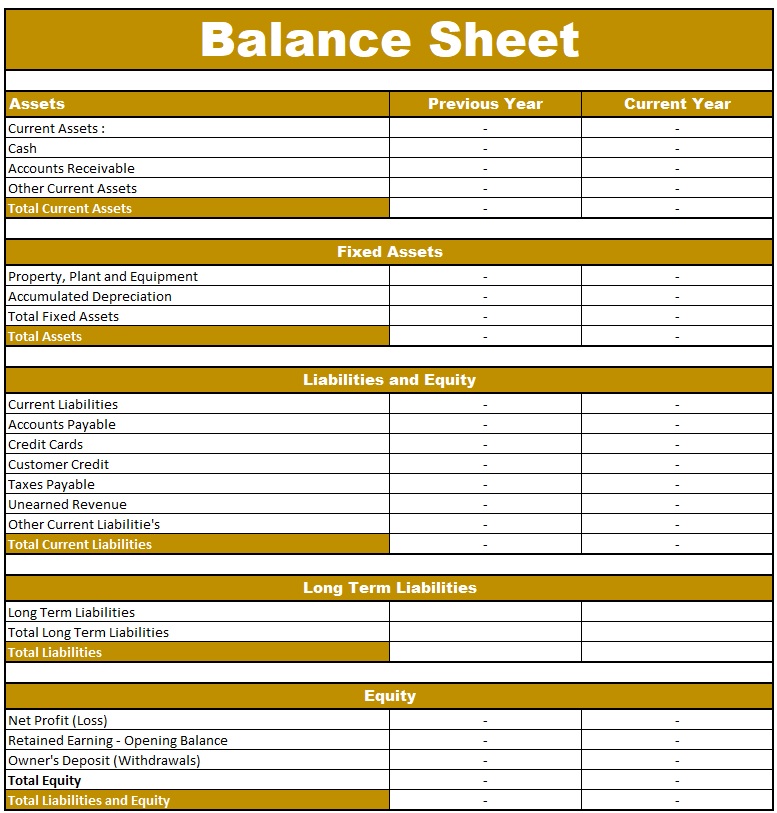

A company’s results of operations are sensitive to proper cost assignment, and management accountants are focused on processes for correctly measuring this information. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular date. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. While the balance sheet can be prepared at any time, it is mostly prepared at the end of the accounting period.

8 Income Statements for Manufacturing Companies

A balance sheet offers internal and external analysts a snapshot of how a company is performing in the current period, how it performed during the previous period, and how it expects to perform in the immediate future. According to the complaint, Rite Aid executives committed financial fraud in several areas, one of which involved inventory. At the end of the company’s fiscal year, the physical inventory count showed $9,000,000 less than Rite Aid’s inventory balance on the books, presumably due to physical deterioration of the goods or theft. Rite Aid executives allegedly failed to record this shrinkage, thereby overstating ending inventory on the balance sheet and understating cost of goods sold on the income statement.

How to Read & Understand a Balance Sheet

In Chapter 2, we look at an alternative approach to recording manufacturing overhead called normal costing. For buyers, our clients tend to be “strategics” or “corporates” that are looking to acquire other manufacturing companies for a various reasons. Sometimes, strategics are looking to diversify their product lines or expand their customer base. In the past few years, sometimes it is simply to obtain “talent” at both the executive and non-executive levels. A number of companies were flush with cash on their balance sheets after COVID-19 and are looking to deploy capital.

- Balance sheets are one of the most critical financial statements, offering a quick snapshot of the financial health of a company.

- This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report.

- Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

- It’s important to remember that a balance sheet communicates information as of a specific date.

Inventory Cost Flow Equation

Inaccurate WIP calculations can confuse procurement teams and negatively impact inventory management decisions. Therefore, it is crucial to implement robust systems for tracking WIP accurately. Utilizing accounting or ERP software specifically designed for manufacturing streamlines transaction tracking from raw material procurement to finished goods sales. Such systems enhance precision and automate record-keeping, significantly reducing the likelihood of errors. In 2015, Old Chang Kee encountered challenges with manual reconciliation and productivity losses due to using separate software for accounting and inventory management.

The income statements of merchandising companies differ from those of manufacturing companies in several areas. In addition, they use the term net purchases instead of cost of goods manufactured and often include the schedule of cost of goods sold in the income statement rather than presenting it separately. Accounting systems are more complex for manufacturing companies because they need a system that tracks manufacturing costs throughout the production process to the point at which goods are sold. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income statements for manufacturing companies. Understanding income statements in a manufacturing setting begins with the inventory cost flow equation. Unlike the income statement, the balance sheet does not report activities over a period of time.

For mid-size private firms, they might be prepared internally and then looked over by an external accountant. Last, a balance sheet is subject to several areas of professional judgement a $10,000 obamacare penalty doubtful that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts.

The total cost of production is credited to the manufacturing account by giving a debit to the trading account. By looking at the sample balance sheet below, you can extract vital information about the health of the company being reported on. It’s important to remember that a balance sheet communicates information as of a specific date. While investors and stakeholders may use a balance sheet to predict future performance, past performance is no guarantee of future results.

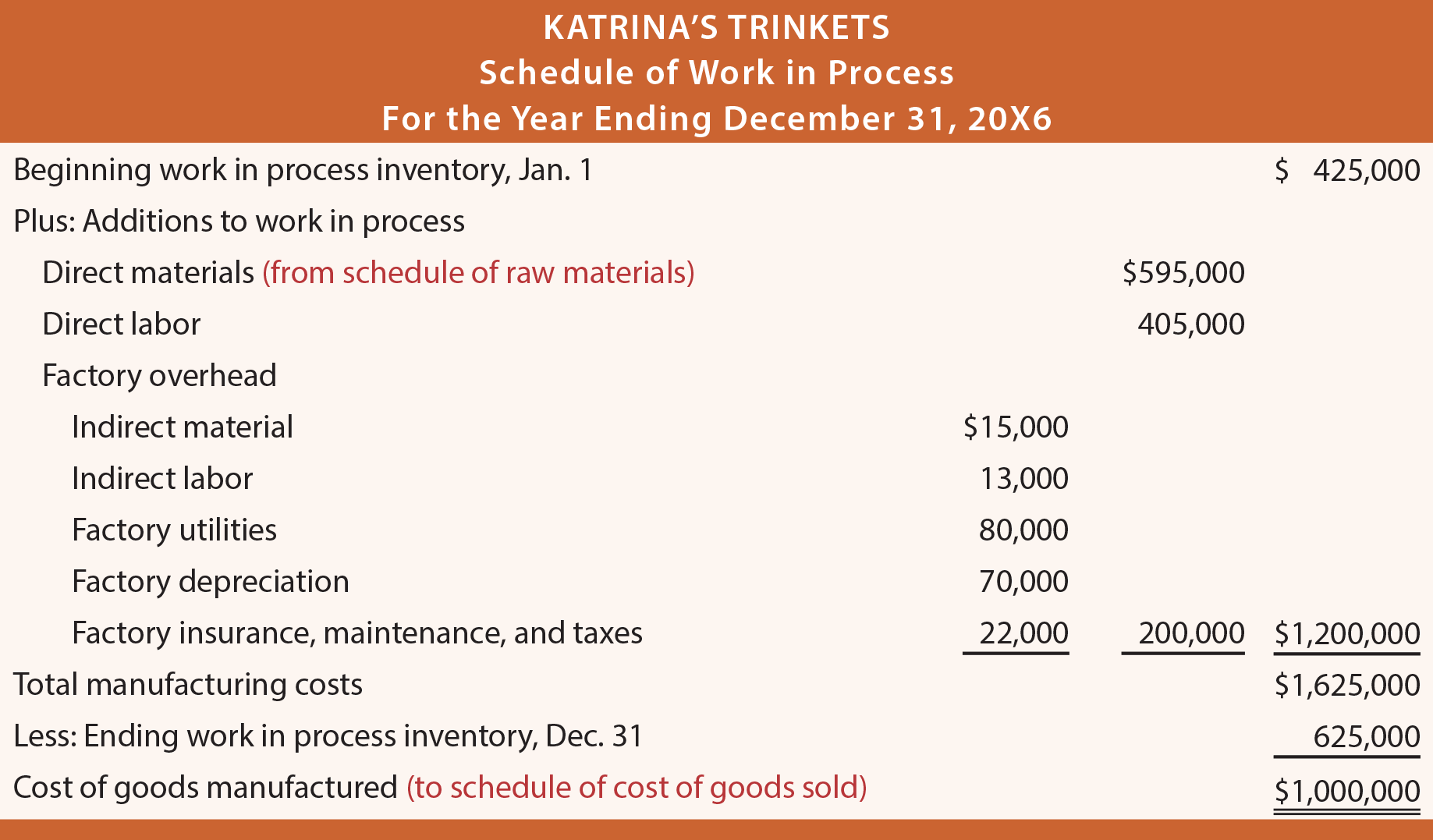

Focusing first on raw material, a company must determine how much of the available supply was transferred into production during the period. The following schedule illustrates this process for Katrina’s Trinkets, a fictitious manufacturer of inexpensive jewelry. Unlike the asset and liability sections, the equity section changes depending on the type of entity. For example, corporations list the common stock, preferred stock, retained earnings, and treasury stock.

Cost of goods manufactured represents the cost of goods completed and transferred out of work-in-process (WIP) inventory into finished goods inventory. Cost of goods sold represents the cost of goods that are sold and transferred out of finished goods inventory into cost of goods sold. One theme throughout all of these transactions is the never-ending search for a proper business valuation. The short-hand way that many companies get there is through a “multiple” that compares the total value of a company’s operations relative to its earnings before interest, taxes, depreciation, and amortization. There are a number of people out there who write countless articles about whether EBIDTA multiples make sense or not. Assume that finished goods are transferred from the factory to the warehouse at production cost plus a 10% manufacturing profit.

現在就與我們聯絡

專人為你評估最合適方案