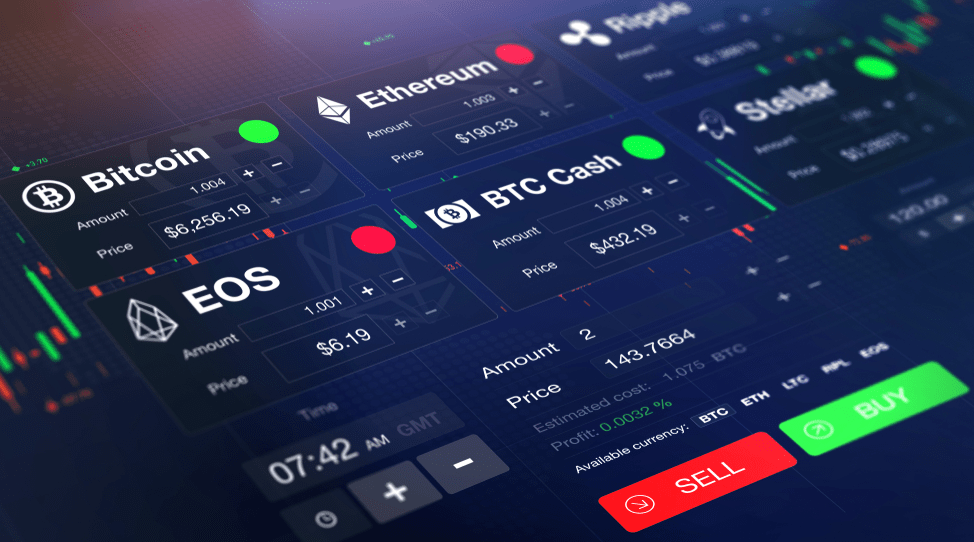

Cryptocurrency rate

The industry leader in volume and golden standard for coin availability. They have some of the lowest per-trade fees in the industry, but some of the other fees on Binance, like withdrawal fees, can be a little sketchy and prone to silently being changed or raised for no reason. https://casino-888.org Additionally, while Binance has been largely stable for a long time, it has been hacked before, and sometimes finds themselves in questionable legal places.

Bitcoin is the currency of the Internet: a distributed, worldwide, decentralized digital money. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever: there is no government, company, or bank in charge of Bitcoin. As such, it is more resistant to wild inflation and corrupt banks. With Bitcoin, you can be your own bank.

While KuCoin technically does not serve US customers on paper, they do not implement any KYC policies and generally have a somewhat openly stated ‘wink wink nudge nudge’ kind of philosophy about servicing places they technically shouldn’t.

How to mine cryptocurrency

For prospective Ethereum miners, it’s essential to understand the significance of their role. Mining requires a combination of technical knowledge, initial capital investment in hardware, and ongoing operational costs, primarily electricity. However, with the impending shift from Proof of Work to Proof of Stake in Ethereum 2.0, the traditional mining landscape is evolving. Future miners should stay informed about these changes and adapt their strategies accordingly.

In September 2022, Ethereum transitioned to a Proof of Stake (PoS) model with its consensus mechanism. This shift marked a significant change in how Ethereum validates transactions and mines new blocks. In PoS, validators stake their ETH to participate in the process. This approach is less energy-intensive and aims to improve network security and scalability. Validators are chosen to create new blocks based on the amount of ETH they stake and other factors, reducing the reliance on computational power. Misbehaving validators risk losing their staked ETH, adding a layer of security against dishonest practices .

Mining Ethereum is not just about maintaining the network’s security and integrity; it’s also a means for miners to earn Ethereum tokens (ETH). When miners successfully validate a block of transactions, they are rewarded with ETH. This incentive structure is essential for the network’s continued health and growth.

For prospective Ethereum miners, it’s essential to understand the significance of their role. Mining requires a combination of technical knowledge, initial capital investment in hardware, and ongoing operational costs, primarily electricity. However, with the impending shift from Proof of Work to Proof of Stake in Ethereum 2.0, the traditional mining landscape is evolving. Future miners should stay informed about these changes and adapt their strategies accordingly.

In September 2022, Ethereum transitioned to a Proof of Stake (PoS) model with its consensus mechanism. This shift marked a significant change in how Ethereum validates transactions and mines new blocks. In PoS, validators stake their ETH to participate in the process. This approach is less energy-intensive and aims to improve network security and scalability. Validators are chosen to create new blocks based on the amount of ETH they stake and other factors, reducing the reliance on computational power. Misbehaving validators risk losing their staked ETH, adding a layer of security against dishonest practices .

Cryptocurrency meaning

The world’s second-largest cryptocurrency, Ethereum, uses 62.56 kilowatt-hours of electricity per transaction. XRP is the world’s most energy efficient cryptocurrency, using 0.0079 kilowatt-hours of electricity per transaction.

Transaction fees (sometimes also referred to as miner fees or gas fees) for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. The ability for the holder to be allowed to set the fee manually often depends on the wallet software used, and central exchanges for cryptocurrency (CEX) usually do not allow the customer to set a custom transaction fee for the transaction. Their wallet software, such as Coinbase Wallet, however, might support adjusting the fee.

Crypto marketplaces do not guarantee that an investor is completing a purchase or trade at the optimal price. As a result, as of 2020, it was possible to arbitrage to find the difference in price across several markets.

現在就與我們聯絡

專人為你評估最合適方案