This tool helps you estimate how much you’ll save or how much you need to deposit if you have a certain amount as your goal. The APY Calculator is a tool that enables you to calculate the actual interest earned on an investment over a year. CAGR and IRR are both measures of return on an investment over a period of time.

Excluding weekends from calculations

Set up automatic recurring transfers to move money into your savings account on a weekly, monthly or quarterly schedule that works for your finances. Automating your contributions is a way to “set it and forget it.” You won’t ever have to manually deposit funds into your account, and your savings will still grow consistently. When you put money into an account that earns compound interest, you aren’t just earning interest on your initial deposit amount (known as the principal). Your interest also earns interest, therefore growing your account balance. So, as we hope you can see, the annual percentage yield (APY) and the APR (or annual percentage rate) are the same if there are no additional cost on the loan and you need to pay the interest once a year. This means that in reality the growth rate in each year may behigher or lower than the CAGR.

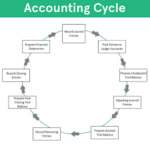

Simple vs. compound interest

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Keep in mind, though, that CDs often offer varying interest rates for different account terms.

Best High-Yield Savings Accounts for June 2024

For the second year, your interest would be calculated on a $1,050 investment, which comes to $52.50. If you reinvest that, your third-year interest https://www.quickbooks-payroll.org/ would be calculated on a $1,102.50 balance. Suppose $100 (PV) is invested in a savings account that pays 10% interest (I/Y) per year.

You’re our first priority.Every time.

All you need to do is just use a different multiple of P in the second step of the above example. See how your savings and investment account balances can grow with the magic of compound interest. We believe everyone should be able to make financial decisions with confidence. As you take the steps to calculate potential interest and shop around to compare different options, you’ll be in a better position to determine if and how a CD fits in your overall financial plan. CNET editors independently choose every product and service we cover.

Compounding can help fulfill long-term savings and investment goals, especially if you have time to let it work its magic over years or decades. You can include regular withdrawals within your compound interest calculation as either a monetary https://www.business-accounting.net/how-much-money-do-you-need-to-live-off-interest/ withdrawal or as a percentage of interest/earnings. When compound interest applies to your savings earnings, you’ll be able to get more value over time, though you’ll always have to factor in APY and the length of time you invest.

With savings and investments, interest can be compounded at either the start or the end of the compounding period. Ifadditional deposits or withdrawals are included in your calculation, our calculator gives you the option to include them at either the startor end of each period. Though high interest rates mean it’s not a great time to be a borrower, it’s a good time to be a saver. Take advantage of the power of compound interest while APYs on savings accounts are high. That’s an extra $42 just for parking my savings in a higher-yield account.

It is a very powerful tool for increasing your capital and is a basic calculation related to personal savings plan or strategy, as well as long term growth of a mutual fund or a stock market portfolio. Compounding interest is the most basic example of capital reinvestment. Use this calculator to easily calculate the compound interest and the total future value of a deposit based on an initial principal. Compound Daily Interest is a powerful force in the world of finance. It calculates interest on your principal amount, including previously earned interest, on a daily basis.

Whether for personal savings, retirement planning, or educational investments, this calculator offers the foresight needed to make informed financial decisions. For example, $100 with a fixed rate of return of 8% will take approximately nine (72 / 8) years to grow to $200. Bear in mind that “8” denotes 8%, and users should avoid converting it to decimal form. Also, remember that the Rule of 72 is not an accurate calculation.

- APY is similar – it is also how much your money will increase by – but this is the most accurate measure as it is over a year and takes compounding into account.

- A is the future value of the investment/loan, including interest.

- You should know that simple interest is something different than the compound interest.

- Note that if you includeadditional deposits in your calculation, they will be added at the end of each period, not the beginning.

As an example, $1000 with a fixed rate of return of 7% will take around 10 (72 divided by 9) years to become $2000. If you invested $10,000 which compounded annually at 7%, it would be worth over $76,122.55 after 30 years, accruing over $66,122.55 in compounded interest. More so six reasons why organic growth is so important if you look at the graph below, the benefits of compound interest outweigh standard interest by $45,122.55. Below you can find information on how the compound interest calculator works, what user input it accepts and how to interpret the results and future value growth chart.

So, let’s now break down interest compounding by year,using a more realistic example scenario. We’ll say you have $10,000 in a savings account earning 5% interest per year, withannual compounding. We’ll assume you intend to leave the investment untouched for 20 years. The higher the balance in an account, the more you’ll earn in interest. Say you deposit $10,000 into that same high-yield account with a 5% APY compounding daily. That breaks down to almost $43 extra cash each month toward your savings goal.

現在就與我們聯絡

專人為你評估最合適方案